Every Monday, I write a newsletter breaking down the business in golf. Welcome to the 33 new Perfect Putt members who have joined us since the last newsletter. Join 9,427 intelligent and curious golfers by subscribing below.

Read Time: 6 minutes.

Today’s newsletter is powered by Old Tom Venture Club.

Old Tom Venture Club is golf’s private investment group. The group currently has four startups innovating in the industry in their portfolio.

Fairgame — Founded by Adam Scott, Benjamin Clymer, and Eric Mayville, whose diverse backgrounds and global influence, particularly that of Mr. Scott, have shaped a unique approach to golf. Their mission is to connect the golf community at all levels, encouraging players to discover and embrace their passion for the game.

Dryvebox — Mobile golf simulators for events, lessons, brand activations and more. Launching 11 new markets in 2024 across the U.S. and Canada with franchisees, you’ve probably already seen them pop up at brand activations with Topgolf or at PGA Tour events. They’re rethinking how to scale indoor golf and make high-end simulator golf easily.

PUTTR — The world’s first AI-powered putting green designed with fun and style in mind. PUTTR connects the world through putting, empowering golfers to improve by connecting and competing anywhere, anytime. Made for professionals and amateurs alike, PUTTR gives you next-gen stats and a true-to-green putting experience to perfect your stroke, enjoy with your friends, or compete against an online community.

Sweetens Cove Spirits—What started as a tradition of taking a shot of bourbon on the first tee at Sweetens Cove Golf Club in Tennessee has grown into a bourbon brand that defines what it means to play and love golf. The definitive spirit of golf, it’s made by and for all who love the game.

A couple of months ago, I wrote a piece breaking down Old Tom. It is the most viewed Perfect Putt piece in the last six months. If you missed the piece — check it out below to learn more about what Old Tom is doing.

Hey Golfers —

Yes — it has been three months since 2023 came to a close. But the last few weeks have produced several reports detailing the 2023 golf industry results.

From a demand and health standpoint — golf thrived in many different aspects in 2023.

Let’s get into it.

National Golf Foundation puts out a golf participation report every year. And it is one of the most important indicators in the industry. Total participation grew by nearly four million in the United States, up 9.4% versus 2022.

A couple of takeaways.

On-course-only golf participation was at 12.1 million. That number was at 13.2 million in 2022 — a decrease of 8%. My analysis on this is fairly straightforward. Golf rounds were up over 4% — if this number were to decrease, it would be a concern (more on this later). What looks to be driving the decrease is more golfers participating in off-course golf and moving them to the ‘both’ category.

Off-course-only golf participation was at 18.5 million. That number was at 15.5 million in 2022 — an increase of 19%. This number makes sense when we look at the dozens of off-course options like Topgolf and Popstroke, adding new venues. The real problem that needs solving is converting these golfers to green grass golfers.

Total on-course golf participants were 26.6 million in 2023 — an increase of 4% versus 2022. NFG also compiled a demographic breakdown comparing on-course golfers from 2018 to 2023. Over 1 million new junior golfers have taken up the game — an outstanding number.

The gold standard metric for green grass golf is annual golf rounds. Over 530 million rounds were played in 2023, an increase of 4.2%. To provide some overall perspective on that number, 441 million rounds were played in 2019. Since 2019, rounds have exceeded 500 million each year.

Public access saw a larger increase in rounds played at 4.5% than private access did at 2.8% in 2023.

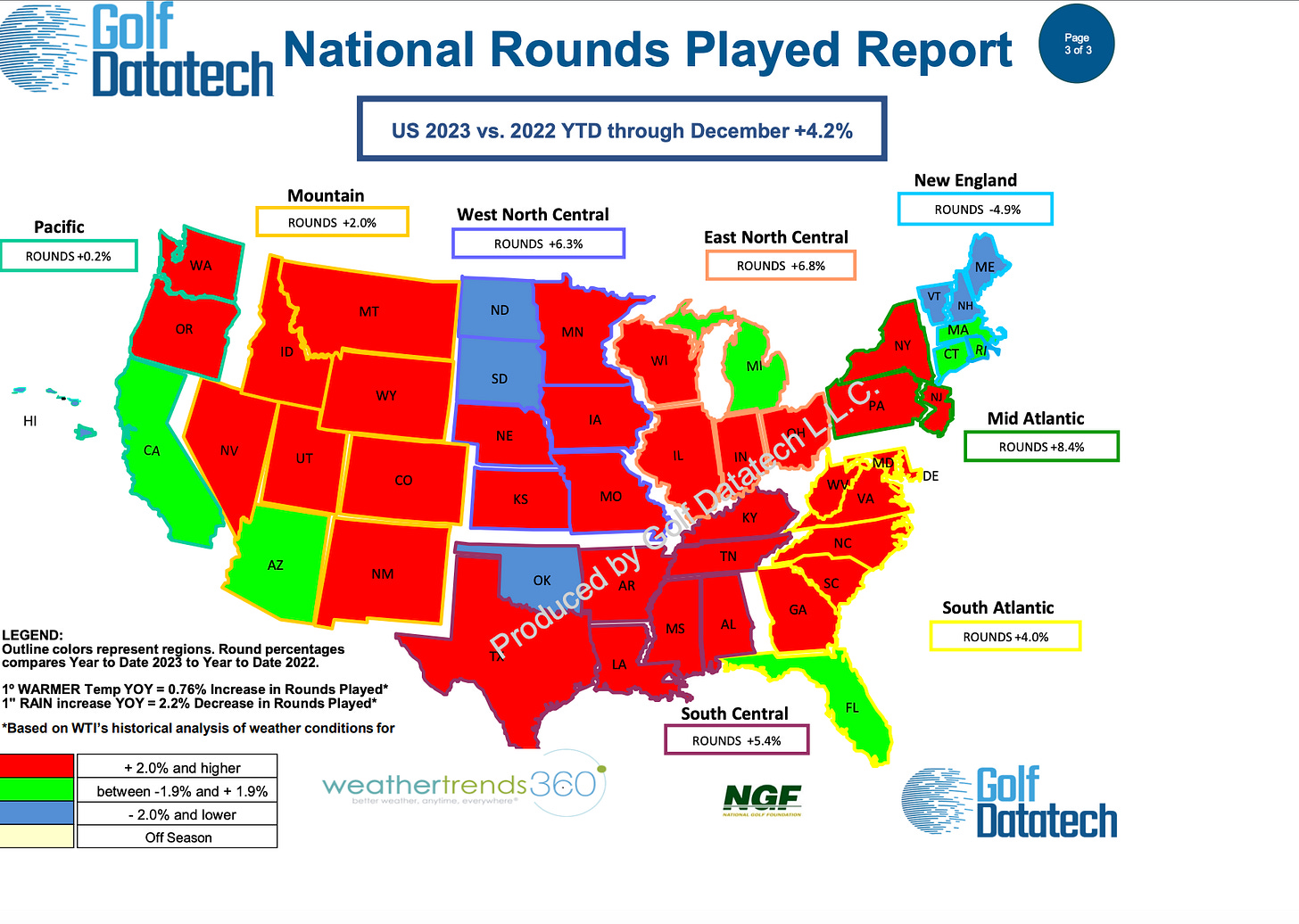

The region with the most significant increase in rounds played in 2023 was the Mid-Atlantic region at 8.4%.

Golf Datatech provides monthly and annual reports on rounds played in the United States. Red is good — and there was a lot of it in 2023.

Some will disagree with my earlier comments stating golf needs to convert off-course golfers to green grass golfers. And I understand those feelings — golf course supply is an issue.

There are around 16,000 golf courses in the United States. From 2006 to 2023 — there has been a net decrease of over 2,000 golf courses. In 2019, there was a net decrease of 2% of the golf course supply in the United States.

We have seen 18 consecutive years of a net decrease in golf course supply. And then, in a matter of four years, we have increased golf rounds by nearly 100 million. That is a recipe for supply issues. And it isn’t a quick fix to add more golf courses. It takes years and millions of dollars.

While the supply issues haven’t impacted on-course growth or golf rounds played. The industry needs to keep a close watch on it in the coming years. Tee times are becoming increasingly difficult to find and more expensive.

Earlier this month — the Los Angeles Times wrote a fascinating piece about the black market tee time issue in Los Angeles. And that is not a good thing. Brokers are charging a $40 booking fee for tee times.

Supply issues can create secondary markets, and that is what has happened in Los Angeles. The overall concern is that this will make golf less accessible, especially for the beginner.

To stay on the Los Angeles theme, I spent some time on the Wayback Machine comparing green fee prices from 2019 to the present. Here are a few examples.

Angeles National — $135 on Saturday in 2019. Now $185 on Saturday in 2024 — an increase of 37%.

Whittier Narrows — $40 on Saturday in 2019. Now $48.50 on Saturday in 2024 — an increase of 21%.

Black Gold Golf Club — $119 on Saturday in 2019. Now $165 on Saturday in 2024 — an increase of 39%.

And I don’t fault the golf courses raising rates. There is no reason to bring them down until golfers aren’t willing to pay the price. That doesn’t mean there shouldn’t be a cause for concern in Los Angeles (and other parts of the U.S.) in making golf accessible to beginners.

Because of the supply issue, indoor golf will continue to grow. I don’t believe the United States will see indoor golf become as popular as a country like South Korea, but I do think golfers will play more indoor golf as long as accessibility is an issue.

The golf industry continues to grow after the Covid bump. And it isn’t showing any signs of slowing down—especially with the junior golf cohort growing at such a healthy clip.

Have yourself a great Monday. Talk to you next week!

Your feedback helps improve Perfect Putt. How did you like this week's newsletter?

If you enjoyed this week’s newsletter, please share it with your friends!

Are you interested in partnering with Perfect Putt? Click the button to learn more about sponsorship opportunities.

Palm Springs greens fees have, unfortunately, gone sky high in the last 8 yrs :(

For ex: Tahquitz Crk-resort back in 16/17 was $35-$40 which included a drink and sandwich! Now, it’s $125 just for the round. Yikes.