Acushnet's $2.38 Billion Year

Every Monday, I write a newsletter breaking down the business in golf. Welcome to the 71 new Perfect Putt members who have joined us since the last newsletter. Join 9,215 intelligent and curious golfers by subscribing below.

Read Time: 5 minutes.

Today’s newsletter is powered by TruGolf.

Meet TruGolf — a Global Leader in Golf Technology.

From Launch Monitors, Golf Simulators, and the industry-standard E6 CONNECT software, TruGolf develops innovative solutions to make it easy to Play, Improve, and Enjoy the game of golf.

This Is Virtual Golf.

APOGEE – This camera-based Launch Monitor is the best tool on the market for golfers looking to improve their game. APOGEE does not require marked clubs or specialty balls.

E6 APEX – Meet E6 APEX, the ultimate golf software solution. E6 APEX features real-time course data, in-depth shot analysis, and graphics you have to see to believe.

The Future of Indoor Golf – E6 APEX and APOGEE have set the bar for realism. The jaw-dropping visuals and lag free gameplay are the new standard for virtual golf.

Meet the Next Generation of Virtual Golf at TruGolf.com.

Hey Golfers —

Titleist is a golf ball juggernaut.

Titleist recognized $761 million in golf ball revenue last year. More than double its nearest competitor in Callaway. Here is some overall context on Titleist golf ball sales.

Over $2 million worth of golf balls were sold every day.

Over $85,000 worth of golf balls were sold every hour.

The company doesn’t disclose its average selling price for golf balls. But the below gives you an idea of how many golf balls were sold every hour in three scenarios.

An average selling price of $1 — 85,000 golf balls are sold every hour.

An average selling price of $2 — 42,500 golf balls are sold every hour.

An average selling price of $3 — 28,300 golf balls are sold every hour.

And Titleist has added over $200 million in golf ball revenue since 2019 — a nearly 40% increase.

Acushnet reported its annual financial results last week. Two things generally get me excited about annual reports.

Evaluating consumer demand.

Looking ahead at the current year forecast.

Let’s dive into the results.

Acushnet breaks its revenue into four different categories.

Titleist golf balls

Titleist golf clubs

Titleist golf gear

FootJoy golf wear

Three of the four categories had positive growth years — FootJoy was down 3.5%. Demand was relatively strong across golf balls and golf clubs.

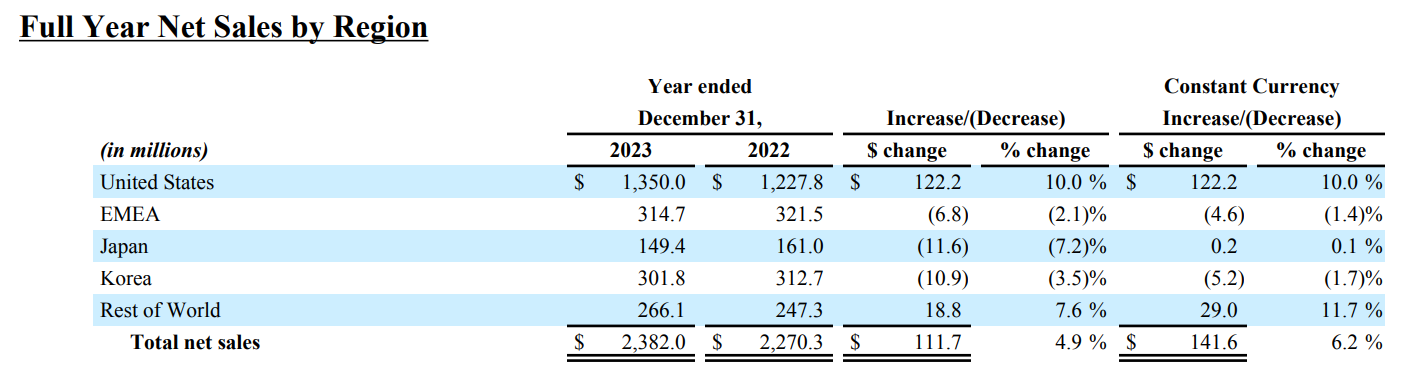

Golfers in the United States primarily drove the growth in 2023 that Acushnet experienced. Revenue was up 10% to $1.35 billion in the United States.

However, revenue growth was down in Acushnet’s three other primary markets.

Acushnet executed where it needed to in 2023.

Golf ball revenue is the largest segment of Acushnet — making up 32% of revenue. And it was their highest revenue growth segment of 2023.

United States revenue is the largest region of Acushnet — making up 57% of revenue. And it was their highest revenue growth region of 2023.

Acushnet’s results show that consumer demand is still strong in the United States. And when we pair the results with NGF’s 2023 report — it looks even better.

531 million golf rounds (up 4%).

1 million net new green grass golfers in 2023.

Comparing Acushnet to Callaway golf ball and golf club sales isn’t necessarily an apples-to-apples exercise. Retail channels play a role when revenue is recognized. But I think the differences are worth noting. Callaway was up 1.5% in golf ball sales and down 2.2% in golf club sales.

Acushnet feels good about the energy and momentum in golf rounds and participation within the industry. They anticipate growth across segments in 2024, with expected revenue growth of around 4%.

An item that I continually think about in regards to Acushnet is its conviction for acquiring companies that support its core business. In 2023 — they acquired Club Glove for $25.2 million.

While Callaway (Topgolf) and TaylorMade (Popstroke) have made significant investments in golf entertainment — Acushnet has not.

Acushnet continues to execute on doing what it already does well — golf balls and golf clubs. They don’t necessarily make splashy or sexy golf entertainment investments.

But do they need to?

I don’t know the answer to that. I’m not sure anyone has the answer to that. Although I believe off-course golf will continue to grow and have a larger impact on the game.

It is worth noting that Acushnet and Callaway have nearly identical golf ball and golf club revenue numbers — around $1.4 billion.

I am fairly certain that the team at Callaway likes where they are regarding the future. And the team at Acushnet feels the same way.

Golf continues to be in a fantastic spot from a business standpoint. And I believe it will continue to get better.

Have yourself a great Monday. Talk to you next week!

Your feedback helps improve Perfect Putt. How did you like this week's newsletter?

If you enjoyed this week’s newsletter, please share it with your friends!

Are you interested in partnering with Perfect Putt? Click the button to learn more about sponsorship opportunities.