Every Monday, I write a newsletter breaking down the business in golf. Welcome to the new Perfect Putt members who have joined us since our last newsletter. Join 10,000+ intelligent and curious golfers by subscribing below.

Read Time: 6 minutes.

Today’s newsletter is powered by Hanna Golf.

I launched Hanna Golf seven weeks ago. Since then, we have sold 102 putters —the big companies sell that in a few hours.

It may not sound like a lot. But I am floored by the response — it has been amazing.

It's an uphill battle — but it's a battle I love. I love competing and getting better. I'm comfortable in this position as the underdog. And that is exactly what Hanna Golf is. An underdog.

Thank you for being a part of the journey.

Hey Golfers —

The Callaway Topgolf split is the biggest business-related golf story in some time— possibly since they announced the original merger four years ago.

Both Callaway and Topgolf are incredible golf brands. And both are two of the world's largest golf companies by revenue. The proposed split is not an indication that either brand has failed. They just didn’t work out together.

Callaway’s original thesis was that the merger would bring two highly complementary brands together. In that thesis, they called out the below.

Topgolf is introducing new players to the game of golf, a powerful trend that benefits Callaway's golf equipment and soft goods businesses.

I tend to agree with that thought. The journey to becoming a green grass golfer looks much different than it did decades ago.

A prospective golfer may have been introduced to the game by a family member or friend. Then, they would likely get a lesson or play nine or eighteen holes on a golf course. The barriers to entry were higher and more intimidating.

Today, prospective golfers have many more touch points for introducing themselves to golf, whether that is YouTube, social media, or golf entertainment. And the barriers to entry are generally lower than they once were, which is a good thing.

Topgolf sits at the top of the funnel to bring in green grass golfers. In 2019, Topgolf served 23 million guests. That number is around 30 million today. And 50% identify as non-golfers.

Callaway wanted to own that distribution and that prospective golfer's journey. This is a very attractive thesis and a marketer’s dream.

Callaway merging with Topgolf would build an enormous moat that other golf equipment companies wouldn’t have. It would be a competitive advantage.

But the merger would only work if Topgolf converted guests to green-grass golfers. And Topgolf does just that — it converts guests to green-grass golfers. It states that around 10% of green-grass golfers credit Topgolf with getting them out on the golf course.

Now, that number is not net new green grass golfers. The actual conversion rate from a Topgolf guest to a green grass golfer is likely much lower.

Pushing even further, the merger would only work if the green grass golfers that Topgolf creates purchased Callaway equipment or other Callaway-related brands.

I believe this is one of the primary reasons for the split. We will get to those in a minute.

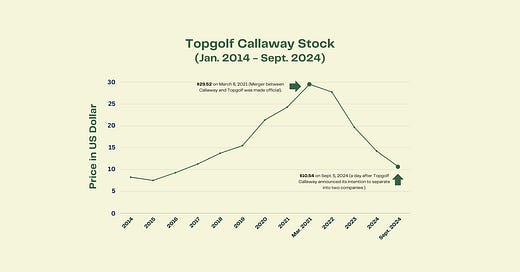

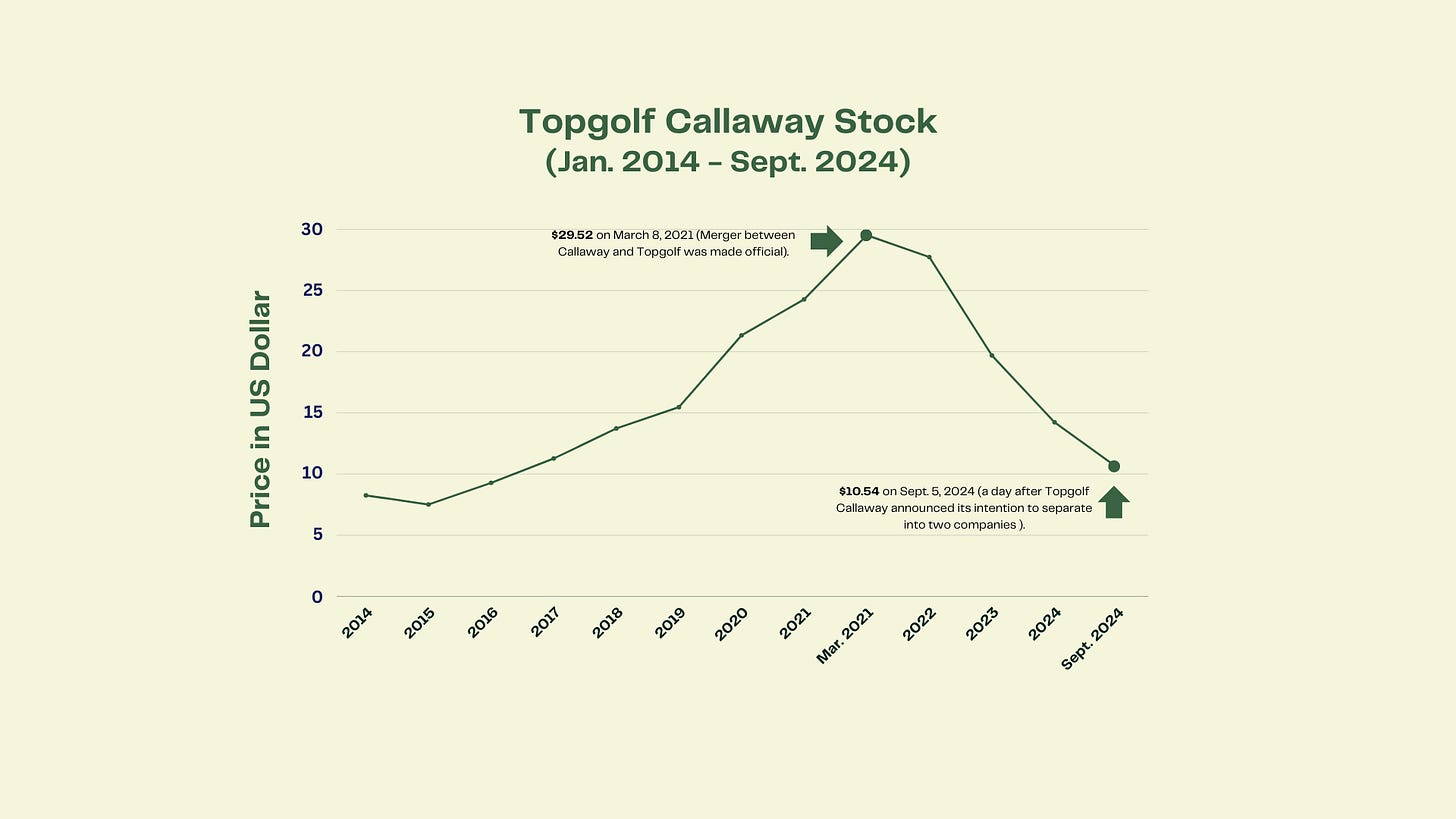

Wall Street hasn’t liked the merger since the day the deal was officially completed. The share price has been down over 60% since March 8th, 2021.

The stock price did not react positively to the announcement to split the companies last week.

The merger was a bold strategy, but bringing those two businesses under one roof has been very complex.

This deal wasn’t like a traditional acquisition we see in the golf space. Take Acushnet acquiring Scotty Cameron, for example. Acushnet already had distribution strategies for golf equipment. They understood how to make golf equipment, how to sell it, and how to grow it.

That deal has worked out very well for Acushnet.

While both Callaway and Topgolf are in the golf space. Their businesses couldn’t be more different from a capital allocation standpoint.

Callaway has not seen material incremental revenue increases in its legacy businesses from the Topgolf merger. I started to get curious about this when Callaway announced they were doing fittings at Topgolf locations during the week of the Masters.

Callaway didn’t announce the results of this campaign. I believe if they were positive, we would have seen something from Callaway.

Think of it like this: Callaway invested around $2 billion (in all stock) to acquire a marketing engine, and it has not seen a return on that investment.

In addition, Topgolf has been performing poorly over the last four quarters. Same venue sales were flat in the second quarter of 2024 compared to the second quarter of 2019.

So now we have a business that has not kept up with the growth of inflation and is not materially increasing golf equipment sales.

Coupled with the above issues and the capital requirements to grow Topgolf, it was time for a change.

The burning question I have that I doubt we will ever see an answer to is leveraging Topgolf locations as a brick-and-mortar distribution strategy for Callaway golf equipment.

There are 100 Topgolf locations worldwide. Why not explore using those locations as brick-and-mortar locations to sell equipment? I’m not talking about selling equipment to Topgolf guests. I am talking about having Callaway brick-and-mortar stores inside its Topgolf locations, where golfers can get early access to equipment, custom fittings, etc.

I believe the answer is channel disruption. Around 70% of golf equipment is sold through retailers. If Callaway moved towards owning more of its distribution, it could hurt its relationships with big-box retailers.

And I would be curious to see if this was Callaway’s initial plan to increase golf equipment sales but saw pushback from its retail partners if they executed that plan.

Callaway plans to spin off Topgolf in the second half of 2025. And Topgolf appears to be getting a good deal. They will be spun off with no financial debt and ‘significant cash’. The amount of cash is unknown. They will also reduce the number of new venues in 2025 to mid-single digits.

Have a great Monday. We will talk to you next week!

Your feedback helps improve Perfect Putt. How did you like this week's newsletter?

If you enjoyed this week’s newsletter, please share it with your friends!

Are you interested in partnering with Perfect Putt? Click the button to learn more about sponsorship opportunities.

Nice note Jared, really enjoy the newsletter, thanks. We had Ben Sharpe, the new Callaway head in Europe on Unofficial Partner podcast recently, who was previously head of Top Tracer. They are keeping that bit of the business in house, which is where the data is collected from the range, allowing them to retain the story that this can then inform individual club purchases. The podcast is here https://podcasts.apple.com/gb/podcast/unofficial-partner-podcast/id1459630823?i=1000666002003

Interesting, as always, Jared. Will be interesting to see where Callaway and TG go from here.